Construction Equipment Price Trends for May 2021

Construction equipment resale and auction prices fell in April compared to the previous month and previous year. Decreased activity in the resale channel could point to signs of construction industry recovery and concerns about securing new equipment.

June 6, 2021

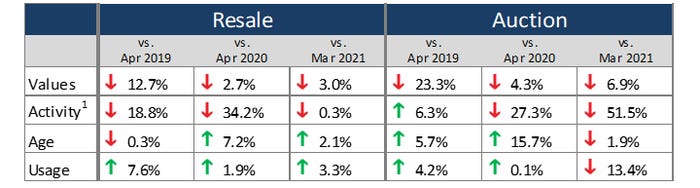

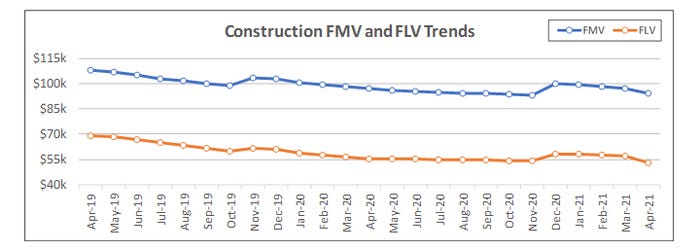

Both FMVs* and FLVs* for construction equipment were down in April 2021 compared to the previous month and the previous two years. Average FMVs were down 3.0% month-over-month, 2.7% year-over-year, and 12.7% compared to April 2019. Average FLVs were down 6.9% month-over-month, 4.3% year-over-year, and 23.3% compared to April 2019.

Activity on the resale channel was relatively flat month-over-month (down just 0.3%) but down by 34.2% compared to April of last year. Similarly, activity on the auction channel was down 27.3% year-over-year. Average age on the resale channel was up 7.2% year-over-year and average utilization increased by 1.9%. On the auction channel average utilization was flat (up 0.1%) year-over-year while average age was up 15.7%.

(Resale activity based on listings; Auction activity based on sales results.)

On the resale channel in particular, this combination of decreased activity year-over-year and increased age and utilization could be pointing to both signs of the construction industry’s recovery and potential concerns about securing new equipment. In terms of industry recovery, while there are many metrics, one could point to the Construction Backlog Indicator[1] from Associated Builders and Contractors (ABC) is particularly salient here. The indicator ticked up again in April from March, reaching 7.9 months, which was a 0.1 increase month-over-month and year-over-year and up from its recent low of 7.2 months in November 2020. Increases to the backlog mean that contractors are booking up more work for the future.

Scarcity, Long Lead Times Becoming a Concern

The second trend we’re hearing from the industry is regarding concerns about securing new construction equipment. In the Q1 2021 Civil Quarterly report from Dodge Analytics[2], it was reported that 36% of respondents have had scarcity (for leased) or long lead times (for purchased) for construction equipment impact their projects over the past six months. Furthermore, 38% said that their company was concerned about scarcity or long lead times for the next six months.

Some OEMs, such as Volvo Construction Equipment (Volvo CE)[3] and Caterpillar[4], have stated that while they have not yet felt the impact of semiconductor shortages in their construction equipment production, they do anticipate that they will be impacted later in 2021. So, while the semiconductor shortage may not yet be to blame for equipment scarcity, what several OEMs have mentioned are low dealer inventories that they are working to replenish. In a press release about Volvo CE’s Q1 2021 financial results[5], the company said, “as well as strong infrastructure investment, low inventory levels at dealers and their need to restock also contributed to the increase in order intake to 73% for Q1, 2021. In comparison to the expected slowdown and uncertainty created by the outbreak of Covid-19 of last year, deliveries across all regions increased.”

CNH Industrial, which boasts both the Case Construction and New Holland Construction brands among many others, went into more depth on the topic of inventories in their Q1 2021 financial results[6]. Their presentation showed both company and dealer inventories for light and heavy construction equipment dropping throughout 2020 and now in Q1 2021 beginning to tick back up.

So, reductions in activity on the used channels, particularly the resale channel, combined with increases in average age and utilization could point to fleet managers wary of selling equipment they have been putting to use and foresee using on upcoming projects if they fear those assets will be more difficult to replace.

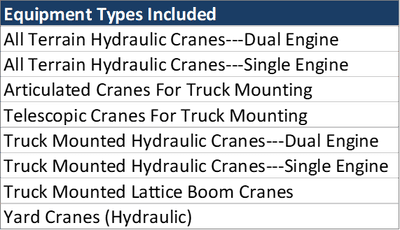

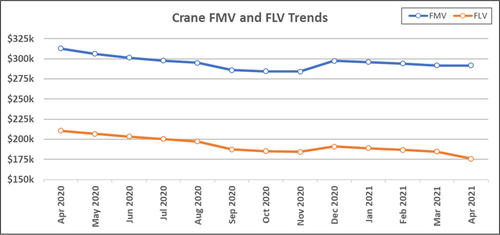

Cranes

This month, we took a closer look at cranes—see the table below for the specific types included:

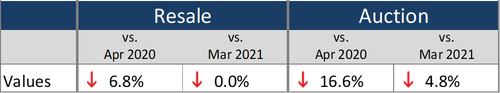

Both resale (FMV) and auction (FLV) prices dropped in April 2021 vs. the previous year. Compared to last month, auction prices dropped 4.8% while resale prices remained the same.

(Resale activity based on listings; Auction activity based on sales results.)

*Fair Market Value (FMV) is the value of an asset sold to a single buyer under no compulsion. Forced Liquidation Value (FLV) is the value of an asset sold at a properly advertised and conducted auction in which the seller is under compulsion to sell on an as-is, where-is basis as of a specific date.

Articles Referenced:

1) ABC’s Construction Backlog Inches Up in April; Contractor Optimism Slips. Retrieved May 19, 2021.

2) Q1 2021 Civil Quarterly Report from Dodge Data & Analytics. Retrieved May 19, 2021.

3) Volvo Says Semiconductor Shortage Impacting Truck Production. Retrieved May 19, 2021.

4) Caterpillar Says Chip Shortage May Hurt Equipment Deliveries. Retrieved May 19, 2021.

5) Good Performance Sees Q1 Sales Increase 23%. Retrieved May 19, 2021.

6) CNH Industrial Q1 2021 Results Review. Retrieved May 19, 2021.

This article is brought to you through a collaboration between EquipmentWatch and World of Concrete 360. The EquipmentWatch Market Report is a monthly resource for the construction, lift/access, and agriculture industries to help equipment managers make better-informed decisions by leveraging key equipment values, market activity, age, and usage metrics. For more information about EquipmentWatch’s methodology and data, and to learn more about what it has to offer contractors, click here.

About the Author(s)

You May Also Like